We’ve all done it. Stood in a showroom, scrolled an online store, or hovered over the “Buy Now” button while quietly thinking, “This will make me look great!” And that’s where things get interesting. Because when it comes to big purchases — cars, tech, clothes, even homes — we’re often not buying for function or value at all. We’re buying for status, identity, and the ‘approval’ of people we may not even like.

The problem? Ego-driven buying decisions usually cost us far more than money.

Let me explain…

Is Ego Sabotaging Our Path to Happiness?

At some point, most of us realise that the things we once wanted don’t always bring the satisfaction we expected. The new car smell fades. The upgrade becomes normal. The clothes that clutter our wardrobe we never wear.

The excitement wears off faster than we thought it would. And quietly, a question begins to surface: Why did I really buy this?

So often, our biggest purchases aren’t driven by need or usefulness, but by ego, comparison, and the stories we tell ourselves about success. Understanding that difference is the first step toward spending your money in a way that actually supports the life we want to live.

The Silent Trap Behind Our Purchases

Why is it so easy to sabotage our path to wealth and the life we really want?

Unfortunately, there are many reasons and just as many ways for us to blow up our path to our perfect lifestyle. One of them is letting our ego run away on its own and make decisions around major purchases.

I recently purchased a new car, and the process was very different from what I have done in the past.

The last time I bought a new car, I was still in the corporate world, on a very decent salary, and surrounded by people who made even more than I did. It was, of course, the sales team – you know, the noisy part of every business that does no work, takes all the glory, and most of the money!

With that came big egos and the never-ending goal to look better than those around you. If someone bought a new car, then the race was on for everyone to get a new car. The more expensive and faster, the better. And of course, if it wasn’t European then it wasn’t even allowed into the company car park.

As it turned out, I did have an eye for Audi’s, but I managed to get away with a reasonably ‘cheap’ model (by their standards) while still being allowed into the work ‘car club’. However, there was always this ongoing pressure to upgrade to something ‘more fitting of my management position’.

Even at the price I paid for a brand-new Audi, there were those who paid 2-3 times as much for their cars! Their first year’s depreciation was almost the total value of my car!

When I look back now, I realise how stupid that was. If it weren’t for my wife, my personal financial controller and voice of reason, I would have fallen for the trap. Which also means I would probably still be working to pay the car off!

Choosing Practicality Over Perception

All this had me thinking – how many purchases do we make simply to look good, rather than considering its value (or lack of)? How much does our ego control the decision process – which has absolutely no idea of value, just a focus on looking better to those around us.

So this time for my new car purchase, I decided I would do things a little differently. I was no longer caught in the corporate machine – no longer surrounded by egos that drowned out my own internal voice of reason. I made a list of things that I wanted in a car that was very specific to me and my circumstances – not of what others might think.

Things like how it worked for my family – Yes, my car had to be easier for my ageing mum to get in and out of. It was no longer fun for the kids to leverage Nanna out of the back seat of a low-profile car when we had a family lunch.

It needed a good warranty (ever notice expensive cars have less warranty?) – all with a view of owning it longer term. Note: short-term turnover of new cars is a massive destroyer of wealth.

I found that I could get a car that drove really nice, had all the features I wanted, and a 7 year warranty for much less…it just didn’t have an expensive brand name attached!

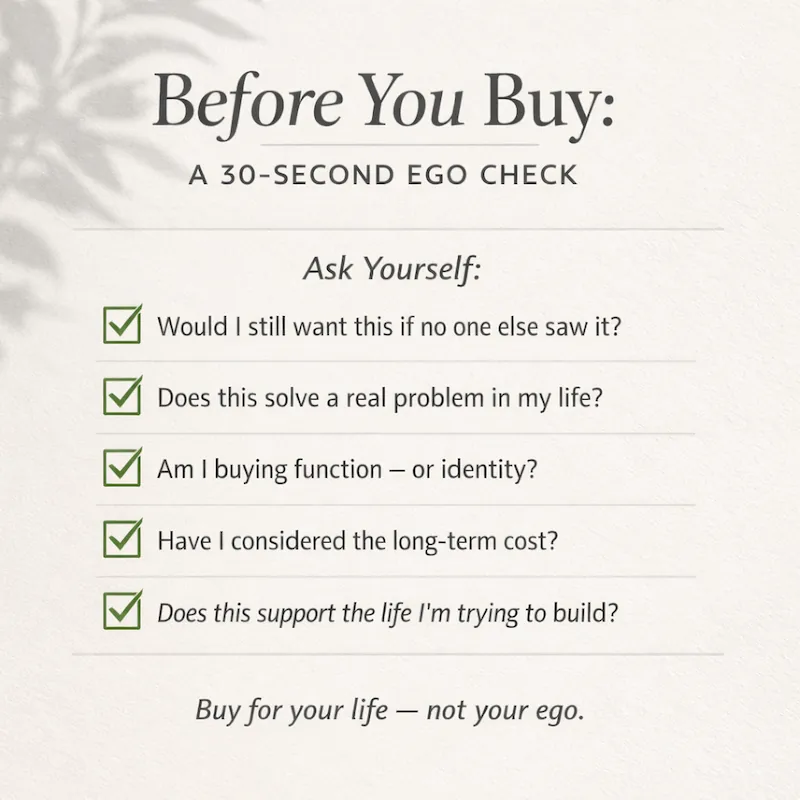

Five Questions to Ground Your Decisions

The whole process really highlighted something that is so important for our wealth creation – and that is how many of our decisions are based on what someone else might think?

Now I’m not saying that we shouldn’t buy nice things, and sometimes splurge on brand-name items. Let’s face it, buying that LV bag, Cartier watch, or BMW X6 does make you feel special. But I do think we need to consider the real reason why we are buying something.

Here are a few simple questions to ask yourself:

- Who are you really buying it for? Is this for my own use, comfort, or joy – or for how I think others will see me? Never buy something to make yourself look better to someone else.

- Does this solve a real problem in my life? What problem does it actually solve, or is it a perceived one due to comparing yourself? Ego loves ‘nice-to-haves’ disguised as ‘must-haves’.

- Am I buying what this represents, or what it actually does? So do you truly need what it does, or just because of the way you look with it? Is there another option that does the exact same thing but for much better value?

- What is the long-term cost? Ego tends to focus on the moment of ‘want’, and not what the long-term implications and ongoing costs. That moment of egoic satisfaction may be very costly over the longer term!

- Does this align with the life I am trying to build? Don’t ask “can I afford it?”, ask yourself “Does this support the kind of life I actually want?”.

If your goal is a life of freedom, financial independence, and peace of mind – does this purchase move you closer or pull you further away? This holds true for so many of our purchases, not just the big stuff!

A purchase that looks and feels impressive today can quietly steal freedom from tomorrow.

Buy For You, Not For Others

Oh, and I have caught up with the guys from my old corporate work and faced the usual sledging about my car. But the biggest surprise was that it was nowhere near as bad as what I thought it might be.

Many of them have been asking how I managed to retire so young, and are interested in following the same path I did – one of which is being very mindful about where your money is going.

Others in the group have also become older, and are seriously looking at retirement. The ego is getting tired and they are looking at things a little differently. The word ‘value’ is used a lot more, which is great. They are starting to measure their purchases, especially the big ones, on the value you get for the money you spend.

Buying for the Life You Actually Want

Most of us don’t overspend because we’re reckless — we do it because we’re human. Our ego wants us to feel successful, respected, and socially secure. But the most meaningful purchases are rarely the flashiest ones. They’re the ones that quietly support the life we actually want to live.

When we learn to pause, question our motives, and choose intention over impression, money stops being a status symbol and starts becoming a tool for freedom.

So what car did I end up buying? A Kia Sportage hybrid – and I love it!

Until next time…

Leave a Reply